A Tale of Two Retirees: Singles Edition

The Tale of Two Retirees: Why a Drawdown Strategy Makes All the Difference

Meet Alex and Taylor.

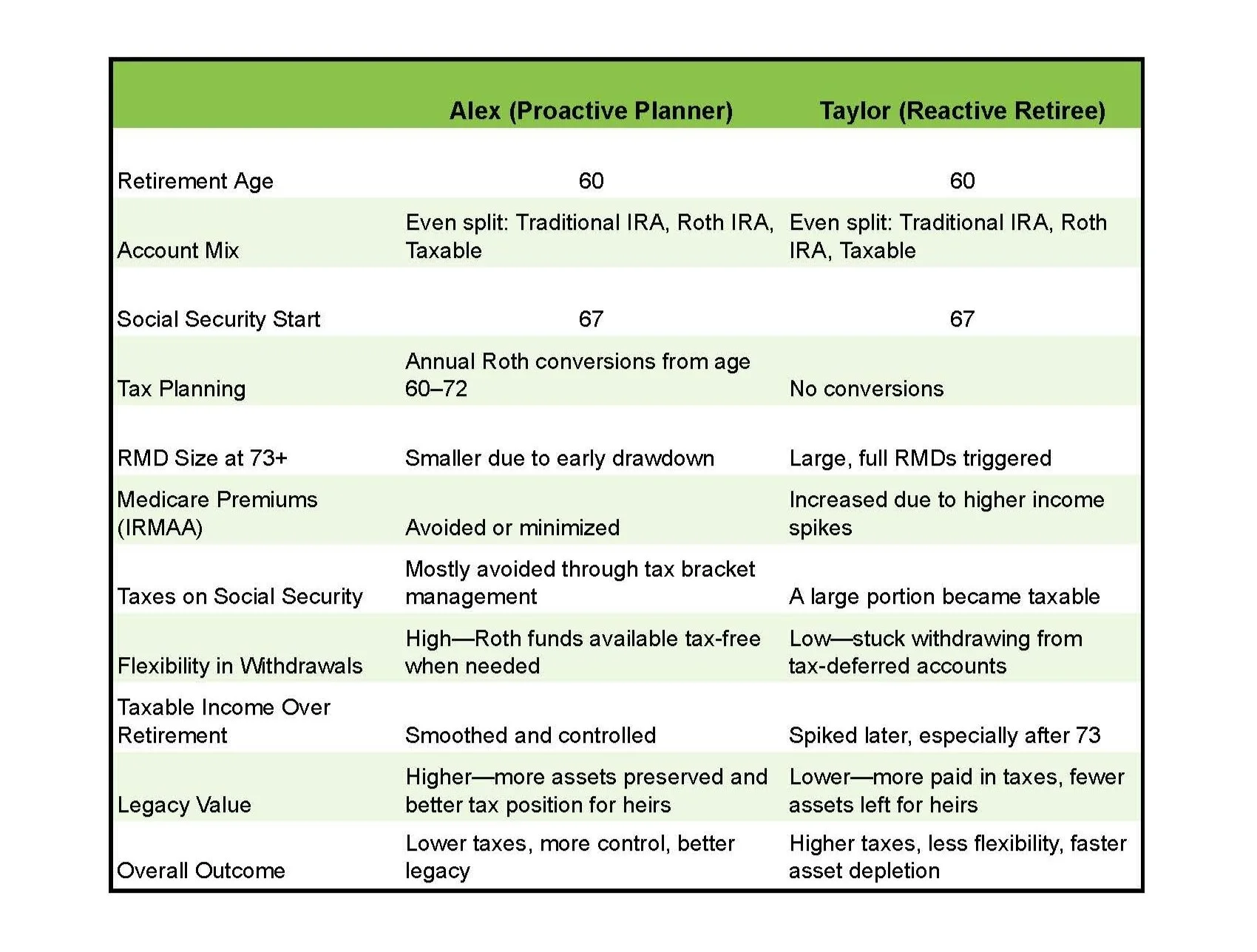

They’re the same age, both single, and both retired at 60 with $1 million in savings. Their money is split evenly across a Traditional IRA, Roth IRA, and taxable brokerage account. They have no pensions or side income—just Social Security, which they both plan to claim at 67. Their retirement goals are simple: maintain their lifestyle, avoid tax surprises, and leave something behind if possible.

But their outcomes couldn’t be more different.

Alex: The Proactive Planner

Alex started planning at age 60. With no income in the early retirement years, Alex saw an opportunity to convert portions of their Traditional IRA into a Roth IRA each year—staying just under key tax bracket and Medicare premium (IRMAA) thresholds. These strategic Roth conversions continued until age 72.

By doing this, Alex:

Reduced the size of future Required Minimum Distributions (RMDs)

Shifted income into lower tax years

Avoided IRMAA surcharges for Medicare

Built a tax-free bucket to pull from later in retirement

Preserved more assets for future legacy goals

Each move was intentional—timed with tax law, income levels, and Medicare milestones in mind.

Taylor: The Reactive Retiree

Taylor also retired at 60 but took a "wait and see" approach. No Roth conversions were done in the early years. By the time Taylor turned 73 and RMDs kicked in, withdrawals from the Traditional IRA caused taxable income to spike—pushing Taylor into higher brackets and triggering IRMAA surcharges.

Because Taylor hadn’t drawn down the IRA earlier:

Taxes increased significantly once RMDs began

Medicare premiums rose unexpectedly

There was no flexibility to tap tax-free income

More of Taylor's Social Security income became taxable

The overall portfolio drained faster due to higher tax drag

What seemed like “playing it safe” ended up being more expensive.

Same Starting Point, Drastically Different Results

Both Alex and Taylor had the same account sizes, the same Social Security benefits, and the same lifestyle needs. But because Alex had a drawdown strategy—and Taylor didn’t—their tax outcomes, healthcare costs, and legacy potential diverged dramatically.

A drawdown strategy isn’t about predicting the market. It’s about controlling what you can: taxes, timing, and the flow of your retirement income.

If you're approaching retirement, the lesson is clear: how you take money out matters just as much as how you saved it in the first place.